What States Does Ebay Collect Sales Tax 2022

Attention What States Does Ebay Collect Sales Tax 2022 all online shoppers! Have you ever found yourself wondering whether or not you need to pay sales tax on your eBay purchases? With the ever-changing landscape of taxation laws, it can be challenging to keep up with which states require eBay sellers to collect and remit sales tax. Fear not, as we have compiled a comprehensive guide for you in 2022 on what states eBay collects sales tax from. So sit back, relax, and let us help demystify this sometimes confusing topic.

What is sales tax?

Sales tax is a tax that is imposed on the sale of goods and services. The tax is generally imposed by the state in which the sale takes place. Ebay collects sales tax for the following states: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Nebraska, NevadaNew JerseyNew MexicoNorth CarolinaNorth DakotaOhioOklahomaPennsylvaniaRhode IslandSouth CarolinaSouth DakotaTennesseeTexasUtahVermontVirginiaWashingtonWest VirginiaWisconsinWyoming

How does sales tax work on Ebay?

When you buy or sell something on Ebay, you may be required to pay state sales tax. The amount of tax you owe depends on the laws of the state where the item is located.

For example, let’s say you live in California and you buy a used car from a seller in Florida. You would have to pay California’s sales tax, which is 7.25%, on the purchase price of the car. The seller would also have to pay Florida’s sales tax, which is 6%, on the sale.

Ebay will calculate and collect the appropriate sales taxes automatically when you check out. You can see a breakdown of the taxes you owe on your purchase history page.

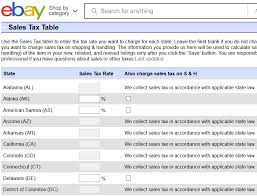

What states does Ebay collect sales tax in?

As of April 1, 2018, eBay collects sales tax on behalf of sellers for transactions made in the following states:

Alaska, Arkansas, Colorado, Connecticut, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Nebraska, Nevada, New Jersey*, New Mexico*, New York*, North Carolina*, Ohio*, Oklahoma*, Pennsylvania*, Rhode Island*, South Carolina*, South Dakota*, Tennessee*, Texas*, Vermont*, Virginia* and Washington*.

eBay also offers tax calculation at checkout for buyers in Canada.

*eBay does not collect state sales tax on behalf of sellers for transactions made in New Jersey or Pennsylvania if the seller has less than $10k in annual sales to buyers in either state.

Do I have to pay sales tax on items I purchase from Ebay?

Sales tax is only charged on items shipped to states where Ebay has a physical presence. Currently, that includes Colorado, Kansas, Kentucky, New York, North Carolina, and Washington. If you live in one of those states and purchase an item from Ebay, you’ll be charged sales tax on the total cost of the item (including shipping).

How do I know if I have to pay sales tax on my Ebay purchase?

If you’re making a purchase from a seller on eBay, you may be required to pay sales tax. This is dependent on the seller’s location, as well as the state where the item will be shipped.

If you’re unsure of whether or not you’ll need to pay sales tax on your purchase, you can check the listing for details or contact the seller directly.

Conclusion

We have discussed the states where eBay will collect sales tax in 2022 and some of the important details to keep in mind when navigating this process. It is essential to be aware of any laws that may affect your ability to charge customers tax on purchases, especially if you are selling across state lines. While it can be tricky, understanding the rules around sales taxes is a crucial part of operating an online business. With Ebay’s easy-to-use platform, sellers can rest assured that they are compliant with all applicable regulations related to sales tax collection and remittance.

![[silent war] taming a tsundere](https://newsipedia.com/wp-content/uploads/2024/04/download-20-1.jpeg)