What Is San Francisco Sales Tax

Are What Is San Francisco Sales Tax you familiar with the ins and outs of San Francisco’s sales tax? As a bustling city known for its diverse culture and thriving economy, understanding local taxes is crucial for residents and business owners alike. In this blog post, we’ll break down what San Francisco sales tax is, how it works, and what it means for you. From restaurants to retail stores, learn everything you need to know about navigating the world of San Francisco commerce with confidence!

What is sales tax?

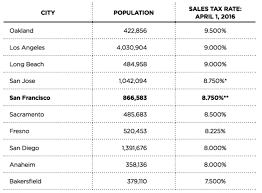

Sales tax is a tax imposed on the sale of goods and services. The tax is typically calculated as a percentage of the purchase price. In San Francisco, the sales tax rate is 8.5%. This means that for every $100 you spend on taxable goods or services, you’ll owe $8.50 in sales tax.

Some items are exempt from sales tax, including groceries, prescription drugs, and certain medical devices. You can also get a sales tax exemption if you’re purchasing items for resale or if you’re a nonprofit organization.

How does sales tax work in San Francisco?

Sales tax in San is calculated based on the total amount of the purchase, including any applicable taxes. The tax rate is 8.5%, which means that for every $100 spent on taxable items, the customer would owe $8.50 in sales tax.

Some items are exempt from sales tax, including food and prescription drugs. Other exempt items may include clothing, books, and certain services. California provides a full list of taxable and exempt items on its website.

Out-of-state shoppers may also be exempt from paying sales tax on certain purchases. To claim this exemption, shoppers must present a valid out-of-state ID at the time of purchase.

What items are subject to sales tax in San Francisco?

Sales tax in San is imposed on the sale of tangible personal property and certain services. The tax rate is 8.5%, which is made up of a state sales tax rate of 7.25% and a local sales tax rate of 1.25%. Some items are exempt from sales tax, including food for human consumption, prescription drugs, and most clothing and footwear.

In general, Tangible Personal Property refers to things that can be seen and touched like furniture, cars, electronics, etc. Services subject to Sales Tax in San Francisco include but are not limited to: hotel accommodations, short-term rentals (less than 30 days), rideshare services, laundry services, and event tickets.

How much sales tax will I pay in San Francisco?

There is no sales tax in San Francisco.

Are there any exemptions to sales tax in San Francisco?

Yes, there are a few exemptions to San sales tax. These include:

-Sales of certain medical devices

-Sales of certain prescription drugs

-Sales of certain food items (e.g. groceries)

-Sales of certain clothing and footwear items (e.g. children’s clothes)

-Certain services (e.g. car repairs)

Conclusion

San sales tax is a complicated and ever-changing system of taxes that citizens must be aware of in order to remain compliant. It’s important to understand how much you owe and when it needs to be paid in order to avoid any potential penalties or interest fees. With the right information, staying on top of your local sales tax obligations can be surprisingly easy – so don’t hesitate to reach out if you need help navigating the process.

![[silent war] taming a tsundere](https://newsipedia.com/wp-content/uploads/2024/04/download-20-1.jpeg)