What Is Sales Tax In Contra Costa County

Are What Is Sales Tax In Contra Costa County you a resident or business owner in Contra Costa County? Do you ever wonder what sales tax is and how it affects your purchases and finances? Look no further! In this blog post, we’ll dive into everything you need to know about sales tax in Contra Costa County – from its definition to its rates, exemptions, and more. So grab a cup of coffee and let’s get started on demystifying the world of sales tax!

What is Sales Tax?

Sales tax is a tax on the sale of goods and services in the United States. Sales taxes are collected by state and local governments at every stage of the sales process, from when a product is first advertised to when it’s delivered to the customer’s door.

Sales taxes vary greatly from state to state, but all states have some form of sales tax. In California, for example, there are seven different types of sales taxes: statewide sales tax, countywide sales tax, special district sales tax, utility district surtax, gross receipts tax on business enterprises (GTRBE), and base erosion and profit shifting (BEP) tax.

Each type of sales tax has its own set of rates and rules regarding when and where it applies. For example, the statewide sales tax in California applies to most purchases made in the state, including those made online or through phone orders. But some purchases – such as groceries or gas – are subject to a lower rate depending on the county in which they’re made.

Because sales taxes are collected at every stage of a purchase, they can add up quickly – especially if you make frequent purchases across many different states. To avoid paying multiple taxes on your purchases, keep track of which ones are subject to which type of sale tax where you live using an online shopping tool like Shopzilla or TaxAct.

Who Needs to Pay Sales Tax?

Sales tax is a mandatory tax that must be paid by both consumers and businesses in Contra Costa County. All goods and services purchased in Contra Costa County are subject to sales tax. There is no exemption for food, clothing, or other basic needs.

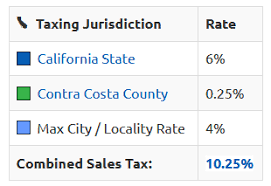

The rate of sales tax in Contra Costa County varies depending on the item or service being purchased. The table below lists the applicable sales tax rates for various items.

Table: Sales Tax Rates in Contra Costa County

Item Tax Rate Clothing 0.7% Food 1.75% Furniture 2% Services 3%

How Does Contra Costa County Tax Sales?

Contra Costa County collects sales tax on most items purchased within the county. There are some exceptions, including food and clothing. While there are many factors that can affect the amount of sales tax you will pay, the County has provided a helpful guide to understand the basics of how sales tax works in Contra Costa County.

If you are unsure about whether or not you need to pay sales tax, it is always best to contact your local Tax Collector’s office for more information.

What Are the Deductibles and Credits for Contra Costa County Taxpayers?

In Contra Costa County, there are two types of sales taxes: a state and local sales tax. The state sales tax is 7.5%, while the local sales tax is 1.75%. Together, these taxes make up the total sales tax in Contra Costa County.

There are several different deductibles that taxpayers may be eligible for when filing their income taxes in Contra Costa County. The most common deductible item is property taxes, which can be deducted up to $10,000 per year. There are also medical deductions available to taxpayers, as well as casualty losses that can be claimed.

Conclusion

In the United States, sales tax is a tax collected on the purchase of goods and services at retail. Most states have a sales tax, which are usually assessed as part of the purchase price. Many municipalities also have their own sales taxes, which are added to the total bill. In some cases, such as with food, supplies used in a business or property bought for personal use, there may be additional taxes that must be paid when purchasing those items.

![[silent war] taming a tsundere](https://newsipedia.com/wp-content/uploads/2024/04/download-20-1.jpeg)