What Is Online Payment

Are What Is Online Payment you tired of making endless trips to the bank, standing in long queues just to make payments? Or dealing with the stress and hassle of carrying around cash all the time? Well, online payment is here to take away all your worries! In this blog post, we’ll be discussing what online payment is and how it works. So sit back, relax, and get ready to learn about one of the most convenient ways to pay for goods and services.

What is online payment?

An online payment is a payment that is made over the internet. This can be done using a credit card, debit card, or even a bank account. There are many different ways to make an online payment, and each one has its own advantages and disadvantages.

One of the most popular methods of online payment is using a credit card. This is because it is quick and easy to do, and you can often get rewards points or cash back on your purchase. However, there are some drawbacks to using a credit card for online payments. First, if you do not have a good credit score, you may be declined for a purchase. Additionally, if you use your credit card for an online payment and the website is not secure, your information could be stolen in a data breach.

Another popular method of online payment is using a debit card. This is also quick and easy to do, but there are some risks involved. First, if you lose your debit card or it is stolen, someone could access your bank account and take all of your money. Additionally, if you use your debit card on an unsecure website, your information could again be stolen in a data breach.

For these reasons, many people choose to use an online payment system such as PayPal or Google Wallet. These systems allow you to pay for purchases without having to enter your financial information directly onto the website. Additionally, these systems often have fraud protection in place so that you can dispute charges if necessary

How does online payment work?

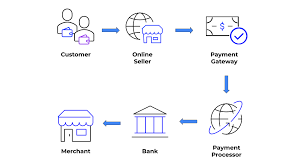

When you make an online payment, you are typically asked to enter your name, address, and credit card information. This information is then sent to the merchant’s website, where it is encrypted and stored. When you make a purchase, the merchant will use this information to process your payment.

There are a few different ways that online payments can be processed. The most common method is through a credit card processor, such as PayPal or Stripe. These companies handle the transaction between the buyer and the seller. The second way is through an online bank transfer. With this method, you will need to have an account with the merchant in order to make a payment.

Finally, there are also digital wallets that can be used for online payments. These work similar to how a physical wallet would work. You can store your credit card information in the digital wallet and then use it to make purchases on the websites that accept that particular digital wallet.

Advantages and disadvantages of online payment

There are advantages and disadvantages to using online payments. One advantage is that it can speed up the payment process. Online payments can also be more secure than other methods of payment, such as mailing a check. Disadvantages of online payments include the potential for fraud and the possibility of delays if there are problems with the payment system.

Which businesses use online payment?

There are many businesses that use online payment methods, such as credit cards, debit cards, and PayPal. Some businesses only accept online payments, while others may offer both online and offline payment options. The following is a list of some common businesses that use online payments:

-E-commerce stores: Online stores typically require customers to make payments using a credit or debit card. PayPal is also a popular payment option for online stores.

-Service providers: Many service providers, such as web designers, offer their services exclusively through online payment methods. This allows them to avoid the hassle of dealing with invoices and other paperwork.

-Recurring billing companies: Companies that offer subscription-based services often use online payments to automatically bill customers on a monthly or yearly basis. This makes it easy for customers to keep up with their payments without having to remember to send in a check each month.

-App developers: Many app developers sell their apps exclusively through online marketplaces, such as the iTunes App Store or Google Play. Customers can purchase apps using a credit or debit card, or sometimes even PayPal.

How to make an online payment

Assuming you would like content for a blog titled , the following outlines key points to make in regards to online payments.

-Online payments are becoming increasingly popular as they offer a fast, convenient and secure way to pay for goods and services.

-To make an online payment, you will need to provide your financial information, including your bank account or credit card number, to the company or individual you are paying.

-Before making an online payment, be sure to check that the website is secure by looking for the “https” at the beginning of the URL address and/or a padlock icon.

-It is also important to remember that you should never pay for goods or services with cash through wire transfer services such as Western Union or MoneyGram as these are often used by scammers.

-Once you have made an online payment, be sure to keep track of the transaction by saving any confirmation emails or receipts.

Online payment security

security is a process by which individuals and businesses can securely send and receive payments over the Internet. There are a number of different methods of online payment, each with its own advantages and disadvantages. The most popular methods include credit cards, debit cards, PayPal, and other online banking services.

When choosing an method, it is important to consider security. Credit cards are the most secure option, as they are backed by major financial institutions. Debit cards are also relatively secure, but there have been instances of fraud in the past. PayPal is a safe option for smaller transactions, but it is not as widely accepted as credit cards. Other online banking services may also be secure, but they may not be as widely available.

It is also important to consider ease of use when choosing an online payment method. Credit cards are the easiest to use, as they can be used anywhere that accepts credit card payments. Debit cards are also easy to use, but they may not be accepted at all locations. PayPal is easy to use, but it may not be accepted at all locations. Other online banking services may be more difficult to use, but they may offer more features and flexibility.

Conclusion

offer a convenient and secure way for consumers to pay for goods and services with ease. With the added benefit of increased security measures, provide an efficient way to transfer money without having to worry about safety or security. Whether you’re using your credit card, PayPal, Apple Pay or any other system, it’s now easier than ever before to make purchases quickly and securely from anywhere around the world. If you haven’t considered using an method yet, why not take advantage of this fast-growing trend today?

![[silent war] taming a tsundere](https://newsipedia.com/wp-content/uploads/2024/04/download-20-1.jpeg)