Understanding Amazon’s Digital Charges on Your Credit Card

Have amazon digital charge on credit card you ever checked your credit card statement and noticed charges from Amazon that you didn’t quite recognize? As much as we love the convenience of online shopping, it can be frustrating to deal with mysterious digital charges. In this blog post, we will dive into understanding Amazon’s digital charges on your credit card so that you can stay informed about your finances and avoid any unexpected surprises. So grab a cup of coffee, sit back, and let’s get started!

What are Amazon’s digital charges?

Amazon’s digital charges refer to any purchases made on Amazon’s website or through their numerous services. These charges can include anything from buying a new book on your Kindle, purchasing a subscription to Prime Video, or even ordering groceries through Amazon Fresh.

One important thing to note is that these digital charges are not limited to just products and services sold by Amazon themselves. Many third-party sellers also use the platform to sell their goods, so it’s possible that you may see charges for items purchased from other vendors.

It’s worth keeping in mind that while some of these digital charges may be recurring (such as monthly subscriptions), others may only appear once for a one-time purchase. If you’re unsure about any specific charge, it’s always best to check your order history on Amazon’s website or app for more information.

Understanding what constitutes as an Amazon digital charge can help you keep track of your spending habits and ensure there aren’t any unauthorized transactions occurring on your credit card.

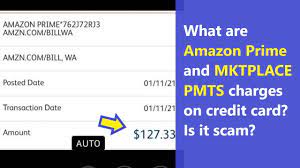

How do these charges appear on your credit card statement?

If you’re an avid Amazon shopper, chances are you’ve noticed some unfamiliar charges on your credit card statement. These digital charges can be confusing at first glance, but understanding how they appear on your statement is the first step to managing them.

Amazon’s digital charges may show up under a variety of names and categories on your credit card statement. Some common descriptors include “AMZN Digital,” “Amazon Prime,” and “AWS Marketplace.” It’s important to review each charge carefully to make sure it’s legitimate and not the result of fraud or unauthorized use.

One thing to keep in mind when reviewing these charges is that they may not always match up exactly with the amount you spent on Amazon itself. This is because many third-party sellers also use Amazon as a platform for their sales, so their fees may be included in these digital charges.

It’s also worth noting that if you have multiple accounts with Amazon (such as an Amazon.com account and an Amazon Prime account), you may see separate charges for each one on your credit card statement.

It’s important to stay vigilant and regularly review your credit card statements for any unfamiliar activity or suspicious charges. By keeping track of how these digital charges appear and where they come from, you can better protect yourself against fraud while still enjoying all of the benefits of shopping online with Amazon.

What do these charges mean for your credit score?

Amazon’s digital charges can have an impact on your credit score, depending on how they are handled. In general, if you pay these charges on time and in full each month, they can actually help to improve your credit score over time.

However, if you fail to pay these charges or make late payments, it could negatively impact your credit score. Late payments will show up on your credit report and affect your payment history which makes up 35% of your FICO Score.

Additionally, having a high balance relative to the limit increases the utilization rate which makes up another 30% of the FICO Score. So it is important that you keep track of these charges and ensure that you are not exceeding your budget so as not to go above 30% of the total available limit.

If you find any suspicious or unauthorized digital charges from Amazon or any other site on your card statement that don’t belong there then dispute them promptly with both Amazon and Credit Card Company.

How can you dispute these charges?

If you notice any digital charges on your credit card statement from Amazon that you don’t recognize or believe to be incorrect, there are steps you can take to dispute them. The first thing you should do is identify the charge and make sure it’s not a product or service that you purchased.

Once verified as an error, contact Amazon customer service and explain the situation in detail. Be sure to have your account information and order number ready for reference. If they agree with your case, they will issue a refund promptly.

Another option is to dispute the charge directly with your credit amazon digital charge on credit card card company. You can call their customer service hotline or file a dispute online through their website. Provide all necessary details of the transaction including dates, amounts, and reasons for disputing.

Be prepared to provide evidence such as receipts or emails exchanged with Amazon regarding the disputed charges. Your credit card company will investigate further before making a decision on whether to reverse the charges.

It’s important to act quickly when disputing these charges because there may be time limits set by both Amazon and your credit card company for filing disputes. Stay vigilant about monitoring your statements regularly so any discrepancies can be caught early on and resolved promptly.

Conclusion

Understanding Amazon’s digital charges on your credit card can be a bit confusing at first, but with the information provided in this article, you should now have a clearer understanding of what they are and how to handle them. Remember to always keep track of your purchases and check your credit card statements regularly for any unexpected charges.

If you do notice any questionable or unfamiliar charges from amazon digital charge on credit card Amazon, don’t hesitate to contact their customer service team for assistance. They will be able to provide you with more information about the charge and help resolve any issues that may arise.

It’s important to stay vigilant when it comes to monitoring your credit card activity. By taking the necessary steps to protect yourself against fraudulent charges, you can enjoy all of the convenience that online shopping has to offer without worrying about any unwanted surprises on your next bill.

![[silent war] taming a tsundere](https://newsipedia.com/wp-content/uploads/2024/04/download-20-1.jpeg)