How To Create A Business Plan For A Loan

Are How To Create A Business Plan For A Loan you struggling to secure funding for your business? Do you feel like lenders are hesitant to invest in your idea because of a lack of structure or direction? The solution may be simpler than you think. By creating a solid business plan, you can give potential investors the confidence they need to support your venture. In this post, we’ll guide you through the steps necessary to create an effective business plan that will improve your chances of getting approved for a loan and help set your company up for long-term success.

What is in a business plan?

A business plan is a document that describes the goals and strategies of a business. It gives lenders information about the business, its strengths, and how it plans to grow. A business plan should include:

-Business overview: This section provides an overview of the company’s history, mission, and key products or services.

-Financial analysis: This section covers how much money the company expects to make in the next year and longterm projections.

-Operating plan: This section outlines how the company plans to operate its current operations and expand into new markets.

-Marketing strategy: This section explains how the company plans to attract customers and generate revenue.

-Financial resources: This section lists all of the financial resources that will be needed to execute the business plan.

-Legal requirements: This section outlines any legal requirements that must be met before starting or expanding the business.

What type of business should have a business plan?

If you are thinking of starting a business, or if you have already started one, you will want to create a business plan. A business plan can help you determine the financial resources that your business needs to survive and grow, as well as provide guidance on how to best market your product or service. There are several types of businesses that may benefit from creating a business plan.

If you are considering starting a franchise, it is important to have a franchise business plan. A franchise business plan will help you identify the key ingredients for success – including an accurate analysis of your competition, research on the franchisor’s brand and system, and an understanding of your target market.

If you are looking to raise money from investors, it is also important to have a proper business plan. The ideal format for such a document includes: an overview of your company and its history; information about your products or services; detailed financial projections; identification of potential sources of funding; development of marketing plans; and more.

Regardless of the type of business you are planning to operate, creating a comprehensive business plan is essential for success.

Why create a business plan?

Creating a business plan is one of the most important steps you can take when starting a new business. In fact, it’s often considered one of the key components to obtaining financing. A business plan not only tells potential financiers all about your company and its mission, but it also provides detailed information on your financial capabilities and strategies.

There are a few things to keep in mind when creating your business plan:

1) Make sure the plan is tailored to your specific business goals and objectives.

2) Be realistic in describing your projected revenues, expenses, and cash flow.

3) document all milestones and changes in your company from inception to present day

4) be prepared to revise and update the plan as needed Throughout the process of preparing your business plan, be prepared to answer questions from potential financiers. By following these tips, you will be well on your way to securing the funding you need for your new venture.

How do you create a business plan?

There are a variety of ways to create a business plan, depending on the size and complexity of your business. The most important element is to develop a detailed plan that includes financial projections, marketing strategies, and other key factors. Some tips for creating a business plan include:

1. Define your business goals. What do you want your business to achieve? What markets do you want to target? What products or services do you offer? Once you know these answers, develop specific objectives and milestones that will help you measure success.

2. Create a mission statement. Why did you start this business? What motivates you to keep going? Capture this essence in a short sentence or phrase.

3. Write down the company’s history and vision. How did it come about? Who are its key employees (past and present)? What makes it different from its competition? Define who your target market is and what they need or want from your product or service.

4. Calculate financial forecasts for the next three years. How much money will you need to start up and run the business successfully? What expenses will be associated with running the business ( rent, salaries, marketing costs, etc.)? Be realistic in your estimates – remember that there will probably be unexpected costs along the way!

5. Put together a market research report exploring where your target market might be found and what they might need or want from your product or service. This report should include

What are the components of a business plan?

A business plan is a comprehensive document that lays out the direction and goals of a company. It should include an analysis of the market, product or service, competitive landscape, financial resources, management skills and marketing plans.

The components of a business plan vary depending on the type of business, but usually includes:

1) Executive Summary: A one-page overview of the company and its goals.

2) Mission Statement: The company’s purpose and what it stands for.

3) Market Analysis: Details about the market segment the company is targeting and how large it is.

4) SWOT Analysis: Strengths, weaknesses, opportunities and threats.

5) Financial Projections: Estimated revenue and expenses over a period of several years.

6) Head Office & Distribution Plans: Maps out where the head office will be located, as well as any distribution channels in place.

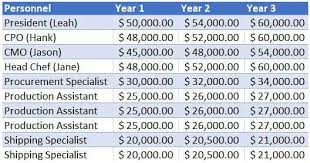

7) Personnel Plans: Details about who will work for the company (including their skills), their salaries and benefits package.

8) Marketing Strategy: Ideas on how to reach potential customers and increase sales.

How do you review your business plan?

If you are considering taking out a loan to grow your business, it is important to create a business plan. A business plan can help you understand your financial goals, identify potential challenges, and develop strategies to overcome them.

Here are five tips for creating a successful business plan:

1. Define your objectives. What are you trying to achieve? Start by clarifying what you want from the business, including profits, growth rates, and market share.

2. Create a realistic timeline. How long will it take to achieve your objectives? Be realistic about how much time and effort will be required. Remember that not everything will happen in the timeframe you expect; sometimes setbacks or delays are unavoidable.

3. Assess risk factors. There are always risks associated with starting any new business venture, but some risks may be more dangerous than others. Evaluate which risks pose the greatest threat to your success and consider ways to reduce or avoid them.

4. Identify funding needs and sources. Your business plan should include estimates of both short-term (three months or less) and long-term (one year or more) needs for funding, as well as information on available sources of financing (i.e., loans, equity investments, etc.). This information will help you make informed decisions about where to seek financing and what terms best suit your needs.

5. Prepare an executive summary and budget overview/table of contents. These two documents should

What do you do if you have updates to your business plan?

If you have updates to your business plan, you should submit them to your banker or lender for review. This will help ensure that your finances are in order and that the terms of your loan are fair. It’s important to remember that lenders are looking for assurance that you have a sound business plan and are capable of meeting your obligations.

If you don’t have any updates to your business plan, then you don’t need to submit anything. Your lender will look at the information in your application package, including your financial statements and projections, to determine if you’re qualified for a loan.

Conclusion

Now that you have a better idea of what a business plan is How To Create A Business Plan For A Loan and the importance of having one, it is time to create yours. A business plan can help you secure loans from banks, investors and other financial institutions, as well as help you identify potential problems early on in your startup so that they can be fixed before they become big issues. By following these How To Create A Business Plan For A Loan simple steps, you will be on your way to creating the perfect business plan for your company. Good luck!

![[silent war] taming a tsundere](https://newsipedia.com/wp-content/uploads/2024/04/download-20-1.jpeg)