Everything about capital one business credit card pre approval

Are capital one business credit card pre approval you a small business owner looking for the perfect credit card? Capital One Business Credit Card Pre Approval is your answer! This process allows you to determine your chances of getting approved for a Capital One Business Credit Card before officially applying. In this blog post, we will guide you through everything you need to know about the pre-approval process, including how to get pre-approved, requirements, benefits and how to use it. Keep reading to discover why Capital One Business Credit Card Pre Approval should be on top of your priority list as a small business owner!

Capital One Business Credit Card Pre Approval

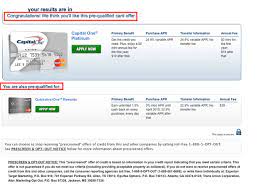

Capital One Business Credit Card Pre Approval is a process that allows small business owners to determine their eligibility for the credit card before applying. This means you can avoid wasting time filling out an application only to be denied later on.

To get pre-approved, simply submit some basic information about your business and financial history. Capital One will then review this information and let you know if you are eligible for the credit card.

One of the main benefits of Capital One Business Credit Card Pre Approval is that it doesn’t negatively impact your credit score. Unlike a formal credit card application, which could result in a hard inquiry on your credit report, pre-approval only involves a soft inquiry.

Another benefit of pre-approval is that it can give you confidence when applying for other types of loans or credit cards. If you know that one reputable lender has already approved you, other lenders may be more likely to do so as well.

In summary, Capital One Business Credit Card Pre Approval can save small business owners time and hassle by allowing them to determine their eligibility before officially applying. It’s also a great way to boost confidence when seeking additional financing options.

How to Get Pre Approved for a Capital One Business Credit Card

Getting pre-approved for a Capital One Business Credit Card can help you save time and make the application process much smoother. But how do you get pre-approved? Here are some tips to help guide you.

First, visit Capital One’s website and check if your business is eligible for a pre-approval. If it is, provide the required information such as your personal and business details including income, credit score, years in business and more.

Capital One will then review your application and let you know if you’re eligible for a pre-approval offer within minutes or up to 7 days depending on whether further verification of your information is needed.

Keep in mind that even with a pre-approval offer, approval isn’t guaranteed – but it does mean that there’s a higher chance of success when applying for an actual card.

Be sure to compare different offers from various providers before making any final decisions as they may differ greatly based on factors like rewards programs or annual fees.

By following these steps, getting pre-approved for a Capital One Business Credit Card can be quick and easy!

What are the Requirements for Capital One Business Credit Card Pre Approval?

To become pre-approved for a Capital One business credit card, there are specific requirements that you must meet. First and foremost, you need to have a good credit score since this is one of the most critical factors in determining whether or not you qualify for pre-approval. Typically, a minimum score of around 680 or higher would be required.

Your business also needs to have been operating for at least two years with an established revenue stream to demonstrate your ability to pay back any debts on time. Additionally, it’s important that your company has maintained clean financial records without any red flags such as bankruptcy filings or tax liens.

In addition to these primary requirements, other factors may come into play when considering your eligibility. For instance, if you already have an existing relationship with Capital One Bank or if you hold other business cards from different issuers – all these can impact the decision-making process positively.

Meeting the necessary criteria can increase your chances of getting pre-approved for a Capital One Business Credit Card – which provides access to rewards programs and helps build up your company’s credit history while making purchases easier!

What are the Benefits of Capital One Business Credit Card Pre Approval?

Capital One Business Credit Card Pre Approval offers several benefits to entrepreneurs who are looking for a reliable and efficient way to manage their business expenses. Let’s take a closer look at some of the advantages:

Firstly, applying for pre-approval can save you time and effort as it reduces the amount of paperwork required in the application process. As Capital One already has your information on file, they can quickly determine if you’re eligible for one of their business credit cards.

Secondly, pre-approval gives you an idea of what kind of credit limit you might expect if approved. This knowledge allows you to plan ahead and make informed decisions about how much money your business needs to borrow.

Thirdly, being pre-approved also means that your credit score won’t be affected until after acceptance, so there’s no risk or harm in checking whether or not you qualify.

Obtaining approval before submitting a formal application will help ensure that any concerns regarding income verification have been addressed beforehand. It also increases your chances of getting approved by giving lenders confidence in your financial stability as a borrower.

Capital one business credit card pre-approval is an excellent option for businesses seeking quick access to funding without sacrificing quality customer service from reputable providers like Capital One Bank!

How to Use Capital One Business Credit Card Pre Approval

Once you receive your pre-approval offer for a Capital One Business Credit Card, it’s time to put it to use. Here are some tips on how to make the most of this opportunity:

Firstly, review the terms and conditions carefully. Make sure you understand the interest rates, fees, rewards program, and any other details related to the credit card.

Next, decide which Capital One Business Credit Card is best suited for your business needs. There are various options available such as Spark Cash Back Rewards or Spark Miles Rewards depending on what kind of incentives align with your company’s spending habits.

Once you have chosen a card that fits within your requirements and budget then submit an application online by using your pre-approved invitation code provided in the mailer or email sent by Capital One.

After submitting an application wait patiently until they will process it. It typically takes several days before receiving approval decision from them but if everything goes smoothly then it should take no more than few minutes.

Activate your new Capital One Business Credit Card once approved so that you can start taking advantage of all its features including perks like cash back bonuses or reward points which can be redeemed for travel expenses or other benefits at participating merchants nationwide!

Conclusion

Getting pre-approved for a Capital One business credit card is an excellent way to ensure that you are able to access the credit you need when you need it. By taking the time to prepare your application and meet the eligibility requirements, you can increase your chances of being approved for a card with favorable terms and rewards.

Remember that even if your initial application is not successful, there may be other options available to help you build or rebuild your credit score over time. By staying focused on your goals and working diligently towards them, you can achieve financial stability and success in both your personal and professional life.

With its wide range of features, benefits, and opportunities for growth, a Capital One business credit card could be just what you need to take your business to the next level. So why wait? Start exploring your options today!

![[silent war] taming a tsundere](https://newsipedia.com/wp-content/uploads/2024/04/download-20-1.jpeg)